The technical data of the publication:

Simon S. (2011): Using Microsoft Dynamics NAV in Environmental Management Studia Universitatis “Vasile Goldis” Arad Seria Stiinte Economice Anul 21 Partea I. - 2011 pp. 100-104

Abstract

The evolution of information society, globalisation, made great transformation processes concerning human-nature relationship. It is very difficult to measure these influences, thus the measures of environmental politics have become more complicated, the legal and market regulation challenges severely the decision making processes of firms.

In decision making it is very important to manage information efficiently. The Dynamics NAV software of Microsoft Corporation is not only capable to model the whole production process through its bill system, but with a proper software development it can be useful e.g. in the calculating and accounting of environmental product charge.

Keywords: environmental product charge, computer aided information system, Microsoft

1. The Theoretical Background of Environmental Product Charge

The detection of the scarceness of natural resources had a strong influence not only on economic philosophy, but the operational instruments of economic management. This phenomenon is related to the theory of sustainable development. In the terms of the Brundtland Report, sustainable development is a development meeting the needs of the present generation without compromising the ability of future generations to meet their needs.

Well-being or quality of life of a population is an important concern in economics. The idea of quality of life takes into account not only the material standard of living, but also other more subjective factors that contribute to human life, such as environmental quality issues etc. Features like environmental health are far harder to measure. This has created an inevitable imbalance as programs and policies are created to fit the easily available economic numbers while balking the other measures, which are very difficult to plan for. These problems are quite acute in the cities of the highly developed countries. (Kováts, I. – Zsarnóczai, S. J. – Zbida, A. 2010)

On the basis of the mainstream theories of economic philosophy the traditional, normative measures were replaced by the indirect, market regulation. Among the relating official, documents of Hungary the most important are these: The Hungarian National Environmental Program, The Hungarian Environmental Law. These documents contain “the polluter pays” and the “user pays” principles.

In the modern preventive type environmental protection the emphasis is put on the prevention rather on the repair of damages. These are such measures which economize raw material, energy, and do not induce environmental pressures. Taxes and fees are useful instruments because of their encouraging features.

2. The Computative and Accounting Background of Environmental Product Charge

The environmental product charge/tax is the price of environmental pressures. These “fees” induce such payments, for which there will be available certain products and services. Such products will be charged with product tax, which are dangeruous for environment during the production, marketing, selling, consumption processes. They can cause problems because of their quantity, or can contain hazardous elements. (European Parliament and Council 1994)

In Hungary the environmental product charge must be paid after certain products, as the tax law prescribes it. The product charge must be paid by that person who sells such products first time in Hungary, or uses, transforms it for his own purposes.

The referring decree particularizes chargeable products in accordance with its Customs Tariff Number. (Környezetvédelmi és területfejlesztési miniszter 1995) Packaging is an exception to the general rule. The referring law (Magyar Országgyűlés 1995) prescribes that payment obligation which is not connected to the sale of packaging material, but the sale or the transformation or consumption. (separating the packaging material from product) of wrapping.

In Hungary the firms must keep a record of chargeable products and their wrapping. In these recordings the master data of products must be recorded and maintained separately. These master data must be completed with the special data necessary for the product charge calculation and its tax return. From the continuously maintained and completed (with the information of sales) product master data will be the basis of the calculation of the environmental product charge payment obligation. Multiplying this sales value with the charge rate or tax rate of the proper packaging material the payment obligation can be figured out.

The followings are the most important master data of a product which must be kept recorded according to the Hungarian legal regulation (Környezetvédelmi és területfejlesztési miniszter 1995): the denomination, the internal id. code (e.g.: item number), the external id. code (e.g.: Global Trade Item Number) , the Customs Tariff Number, the “KT” code, the weight and the charge/tax rate of the chargeable product or component.

This decree also defines the parameters of the administration of the product charge regarding to the stocking of chargeable assets. In this case it is also important to keep a record about the Global Location Number and the VPID number (similar to: Economic Operators Registration and Identification number) of the firms.

3. Modelling in Microsoft Dynamics NAV

In general the date of sale transaction written on the invoice is the date of the arise of payment obligation of the environmental product charge, the modification of 2008 of the (Magyar Országyűlés 1995) law defines the possibility to do the duty concerning to product charge from the date of stocking, so in this case the liability arises from the purchase.

Nor the basic version of the software nor the Hungarian localisation is not prepared for this administration and accounting of product charge, so the manufacturer company released an add-on software: “Microsoft Dynamics NAV 5.0 SP1 Feature Pack 1”.

In the followings I will evaluate the usefulness of this add-on software analysing its adequacy to manage the calculation and administration of product charge. The researches on competencies for controlling and the calculation on product charges, packaging costs of ERP systems are very popular. (Decker 2008; Daneva et al. 2008; Rhoma et al. 2010; Zhang et al. 1996)

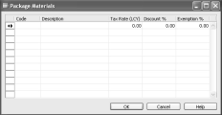

While installing the add-on (FP1) additional tables, menus and data fields appear in the tables and forms of the original software. One of these new objects is the “Package Material” new table. (Figure 1.) It gives the possibility to name, to give a code to the package materials (Code and Description fields), to enter the per unit of weight value of the environmental product charge (amount of Tax Rate ) given in the decree (Tax Rate (LCY) field), to enter the percentage of discount that is awarded to “eco-friendly” packaging materials (Discount % field), to enter the percentage of exemption company can be awarded if it has some recycling agreements with some waste management company (Exemption % field).

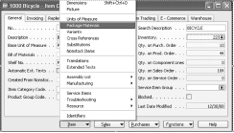

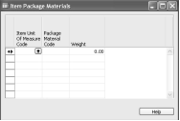

Another important change appears in the „item card” form after the installation. (Figure 2.) Clicking to the “Item” button a new menuitem appears with the expression “Package Material”. Clicking on this menuitem another new table appears. (Figure 3.) Filling out this table it is easy to modify „item cards”, to enter the input information of product charge calculus.

This way it is simple to prepare the accounting of product charge for that case when the liability arises from the purchase. In the “Item Package Materials” table we can enter the internal code of the chargeable product, the internal item unit of measure code (e.g. kg), then the package material code referring to the “Package Material” table (using the "look up" menu), and the quantity of the item unit of measure.

The most important aim of calculating product charge is to make out tax return, so it is useful to obtain the product charge at the end of the account period. We must run a report that will calculate the product charge or package tax for the period. In Financial Management application domain clicking on these menuitems (Inventory – Reports – Package Tax Calculation) the report’s request form can be opened and filled out.

Evaluating the software we can declare that the Ms Dynamics NAV 5.0 SP1 Feature Pack 1 software is a really useful add-on. The environmental product charge can be calculated easily, the account of it is quite automatic. At the end of the account period requesting a NAV report the value of product charge can be obtained. The input data of the calculus can be entered simply: there are some new tables mainly connected to item card form which can be filled out easily.

For making out tax return it would be useful to warehouse the relevant data in one database, I suggest to make some more fields in “Package Material” table for those data which are compulsory for filling out tax return documents. There should be fields denominated for the following expressions: “Global Trade Item Number”, “Customs Tariff Number”, “KT code”. Denominating fields in the tables of Ms Dynamics NAV some programming knowledge is needed, and very often this is not available for end users. It is another problematic part of the add-on, that it cannot be installed easily for the demo database (Cronus Inc.) made for Hungarian users.

Figure 1.: Data of Packaging Materials for Product Charge Calculation

Figure 2.: The Menuitems of the Modified Item Card

Figure 3.: Packaging Material Requirement Relatded to Items

References

Daneva, M. Wieringa, Æ Roel 2008: Cost estimation for cross-organizational ERP projects: research perspectives Software Quality Journal 16 p. 459–481

Decker Ch, Berchtold M, Weiss L, Chaves F, Beigl M, Roehr D, Riedel T, Beuster M, Herzog T, Herzig D 2008: Cost-benefit model for smart items in the supply chain IOT'08 Proceedings of the 1st international conference on The internet of things Springer-Verlag Berlin, Heidelberg

Kováts, I. – Zsarnóczai, S. J. – Zbida, A. (2010): Sustainable City – Developing Deals of the European Union (2007-2013) In: Szent istvan University Faculty of Economic and Social Sciences Management and Business Administration PhD School: Economics of Sustainable Agriculture Scientific Book Series Gödöllő 2010 p.11-26.

Rhoma, F. Zhang, Z. Luo Y. Noche B. 2010: Environmental & economical optimization for municipal solid waste collection problems, a modeling and algorithmic approach case study MAMECTIS'10 Proceedings of the 12th WSEAS international conference on Mathematical methods, computational techniques and intelligent systems World Scientific and Engineering Academy and Society (WSEAS) Stevens Point, Wisconsin, USA

Zhang, Y.F., Fuh J.Y.H., Chan W.T. 1996: Feature-based cost estimation for packaging products using neural networks Computers in Industry 32 p. 95-113

European Parliament and Council (1994): Directive 94/62/EC of 20 December 1994 on packaging and packaging waste

Környezetvédelmi és területfejlesztési miniszter: 10/1995. (IX. 28.) KTM rendelet a környezetvédelmi termékdíjról, továbbá egyes termékek környezetvédelmi termékdíjáról szóló 1995. évi LVI. törvény végrehajtásáról

Magyar Országgyűlés: 1995. évi LVI. törvény a környezetvédelmi termékdíjról, továbbá egyes termékek környezetvédelmi termékdíjáról